Australian Digital Marketing Agency Based In Perth

Sales Driven Digital Marketing That Grows Businesses

We Aren't Just a Digital Marketing Agency Doing SEO, PPC, Social Media Marketing, Website Development and Content Marketing We Work With You As a Growth Partner To Grow Your Business

I’ve been working with Jarrod & Serena for nearly a year now and have seen substantial growth in my business. Unlike other companies that I have dealt with in the past they are the real deal. They monitor all their Ad & SEO campaigns, constantly critiquing, to ensure that a revenue generating outcome is achieved. Highly recommend their services.

Laserclear A.

Verified Google Review

Business Warriors are the best marketing agency I’ve worked with so far, they deliver extraordinary results in a timely manner, along with their great experience in the field through which they can lead businesses to huge success.

Dua F.

Verified Google Review

I have been working with Jarrod for 3 years now. I tripled my income in 3 days working on my own in a hair salon. Now I own 3 businesses and have 5 staff. We are constantly growing and I couldn’t do it without the Business Warrior team. I highly recommend Jarrod and invite you to trust in him.

I am happy for anyone to give me a call and ask me for my experience. I am still currently working closely with the team.

Karina D.

Verified Google Review

I cannot speak of Jarrod and his team highly enough! I was very nervous at first because I had been let down by 2 marketing agencies in the past. But I decided to trust my instincts with Business Warriors, and I have not looked back!!! my business has grown in revenue ever since. These guys know their stuff, they listen and implement fast and when things are not giving me results, they take the initiative to tweak things until we get results. This is 1 part of my business I feel like I don't need to worry about, and they feel like part of my team and always cheer me on too! We are now working together for nearly 2 years and they are helping me kick my sales goals each month. Do yourself a favour and sign up with Business Warriors, your business will thank you in the numbers!

SkinFit New Farm

Verified Google Review

STRATEGY CUSTOMISED TO YOUR BUSINESS AND SITUATION

To succeed in the australian digital marketing space its important that you have a fully customised strategy for business growth

RESULTS FOR YOUR BUSINESS THATS ALL THAT MATTERS

Return on investment is where all strategy starts and ends our digital marketing agency believes it is the benchmark for your businesses growth

GET EVERYTHING DONE FOR YOUR BUSINESS YOU NEED TO SUCCEED

You think of it, we do it. We are a full service digital marketing agency because we believe everything you do should be in the one house, so that everything can be strategically integrated so the message is clear across all platforms your business marketing is executed

GROWING YOUR BUSINESS ALL STARTS WITH OUR COMPLIMENTARY FREE MARKETING PLAN VALUED AT $1500

Our Australian Full Service Digital Marketing Agency Services Are Completely Done For You

Driving Growth For Businesses Across Australia

FOCUSING ON JUST ONE FORM OF MARKETING DOESNT WORK ANYMORE

We hear this too often "I used an agency previously and I didn't get the result" Or "My Current Agency Doesn't Understand My Business" This is a large reason why we do a FREE MARKETING PLAN upfront because it helps us fully understand your business. If you are like a lot of other businesses and you get growth by keeping clients and getting customers to always come back and buy more products and services from you at higher price points to increase the lifetime value of each client/customer then this is why you need more than one form of marketing.

We all know having first movers advantage in business has huge advantages however imagine being the first person a client sees before they are ready to buy your product or service. But to also be there to capture people when they are ready to buy and then get them to repeat business with you time and time again. This is how businesses are grown and how you will grow your business in 2024

what digital marketing services can we provide

PPC ADVERTISING

PPC advertising works by allowing advertisers to bid on specific keywords or phrases that are relevant to their target audience. Advertisers can create ads that will be displayed to users who search for those keywords or phrases. When a user clicks on an ad, the advertiser pays a fee to the platform where the ad was displayed.

CONTENT MARKETING

If you want to become the go to

business in your area content marketing is a big part of this, its not just take photos and putting them on your social media profile that will get you the result in your content marketing strategy

SEARCH ENGINE OPTIMISATION

Too many business don't optimise what they current have around their business in order to been seen by their ideal clients use SEO to be seen by your clients without having to pay for the eyeballs

SOCIAL MEDIA ADVERTISING

Social media is a pivotal part of growing your business know what to post, when to post and how to post it so it effectively builds the brand in a machine that gets people to click through to your website or into your booking system to book a service with you or buy products

WEB DEVELOPMENT

Building a website is ok but building a website that converts traffic into bookings and sales for your business is a completely different thing we help create website that convert traffic to bookings for your business

FUNNEL DEVELOPMENT

If you have a specific offer your

business uses to bring in new clients this is where you would want a funnel created to get people to buy your service online

CONVERSION RATE OPTIMISATION

Your business conversion rates extend a lot further than you or your team answering the phone, it also stems too your consultations, your product sales, your website visitors to booking or sale rate optimising these areas by as little as 5% can make a large difference as to where your business growth will be in as little as 12 months

EMAIL & TEXT MARKETING

Email and text message marketing is the ultimate way to continue to keep your current clients active and to continue to buy from you ever single week, month and year

BUSINESS COACHING

Getting new clients is great, but how do you get clients to come back 3, 4, 6, 10, 15 times a year and create a delivery model that helps you grow with more predicatbility

WHO IS BUSINESS WARRIORS

Business Warriors has evolved over the years to the digital marketing agency in Perth that helps businesses to scale through predictable and scalable sales and marketing acquisition systems while making sure to remain profitable with the appropriate systems and processes.

Our specialty is helping your business to increase the amount of visibility you get daily through specific content marketing and SEO Strategy using the algorithm to your businesses advantage.

We then like to increase your businesses conversation rates through sales training, website optimisation and conversion rate testing systems.

Once these things are done, we add fuel to the fire with bulletproof hyper targeted PPC advertising and social media marketing retargeting to accelerate your results over the long term.

We like to set big targets and provide guarantees to our clients otherwise we don't get paid for what we do. We also serve various industry markets, including automotive marketing, childcare center marketing, adult SEO, medical marketing, and medical SEO.

www.growasalon.com is a product company owner by http://www.businesswarriors.global our registered company is Business Warriors Pty Ltd

wHAT CAN BE DONE tO hELP YOU

Warriors Hook A Killer Offer To Hook In Your Ideal Client

Pick your battlefields (Social Media Marketing Meta Advertising across Facebook, Instagram and whatsapp, LinkedIn Marketing, Google Advertising, Bing advertising, TikTok Advertising, and SEO (Search Engine Advertising)

Content Marketing to acquire brand awareness and buyers before their ready to buy, paid ads and organic content marketing to find people when their ready to buy and email marketing and text marketing to get clients to buy from you time and time again.

Warriors Strike (making the right offer in front of your ideal dream clients

that will pay you the most)

Doubling the number of enquiries your business gets in a 12-month period

The Warriors conversion formula (setting appointments & getting them to

show up)

The Warriors Pitch (the most tested selling system ever, for real) so you

and your team close a higher ratio of leads coming through your campaigns

How to create world class products and high-priced products and services and

experiences for your clients so that you can charge a premium and stand out

from everyone else

How to keep feeding your business from this skill for years to come

(retention of clients)

How to leverage yourself and build world class high performing sales teams

Plus so much more

BLOG

Understanding What is Business Insurance for Your Clinic

Business insurance might sound like just another box to tick for clinics and salons, but the reality is much bigger. Shockingly, one major claim or lawsuit can wipe out years of hard work overnight. Most clinic owners think insurance is only about meeting legal requirements and forget it is actually a powerful shield that can keep the doors open and protect everything they have built when things go pear-shaped.

Table of Contents

What is Business Insurance and Its Purpose?

Understanding Business Insurance Fundamentals

Types of Business Insurance Coverage

Importance of Business Insurance for Clinics and Salons

Financial Protection and Risk Mitigation

Comprehensive Coverage for Service Industries

Types of Business Insurance Relevant to Service Industries

Core Insurance Categories for Service Businesses

Professional and Operational Risk Coverage

How Business Insurance Works in Real-World Scenarios

Claims Process and Risk Assessment

Practical Insurance Scenario Examples

Key Concepts and Terms in Business Insurance Explained

Advanced Insurance Conceptual Framework

Turn Risk into Reliable Growth for Your Clinic or Salon

What is the primary purpose of business insurance for clinics?

What types of insurance coverage do clinics typically need?

How does the claims process work for business insurance?

Why is professional indemnity insurance important for clinics?

Quick Summary

Business insurance is essential for financial protection.

It safeguards businesses from unexpected financial losses and risks, ensuring stability and continuity during unforeseen events.

Service industries need specialized insurance coverage.

Clinics and salons face unique risks; tailored insurance products like professional indemnity and public liability are critical for their protection.

Understanding insurance terms aids informed decisions.

Familiarity with key terms like premiums, deductibles, and policy limits empowers business owners to negotiate better insurance policies effectively

.Claims process is crucial for policy benefits.

Knowing the steps involved in submitting a claim, from documentation to resolution, helps businesses effectively access their insurance support when needed

.Comprehensive insurance fosters business credibility.

A well-structured insurance plan demonstrates professionalism, potentially attracting clients and enhancing trust in service-based businesses.

What is Business Insurance and Its Purpose?

Business insurance represents a critical financial protection mechanism designed to safeguard organisations against potential risks and unexpected financial losses. At its core, business insurance is a strategic risk management tool that provides comprehensive coverage for various potential scenarios that could otherwise devastate a clinic or service-based business.

Understanding Business Insurance Fundamentals

Business insurance operates as a contractual agreement between a business and an insurance provider, where the insurer agrees to compensate the business for specific types of financial losses in exchange for regular premium payments. According to Australian Business Insurance Guidelines, these policies help transfer potential risks away from the business, ensuring financial stability and operational continuity.

The primary purpose of business insurance extends beyond mere financial protection. It serves multiple critical functions:

Protecting business assets and physical infrastructure

Mitigating potential legal and financial liabilities

Providing peace of mind for business owners and stakeholders

Ensuring business continuity during unexpected events

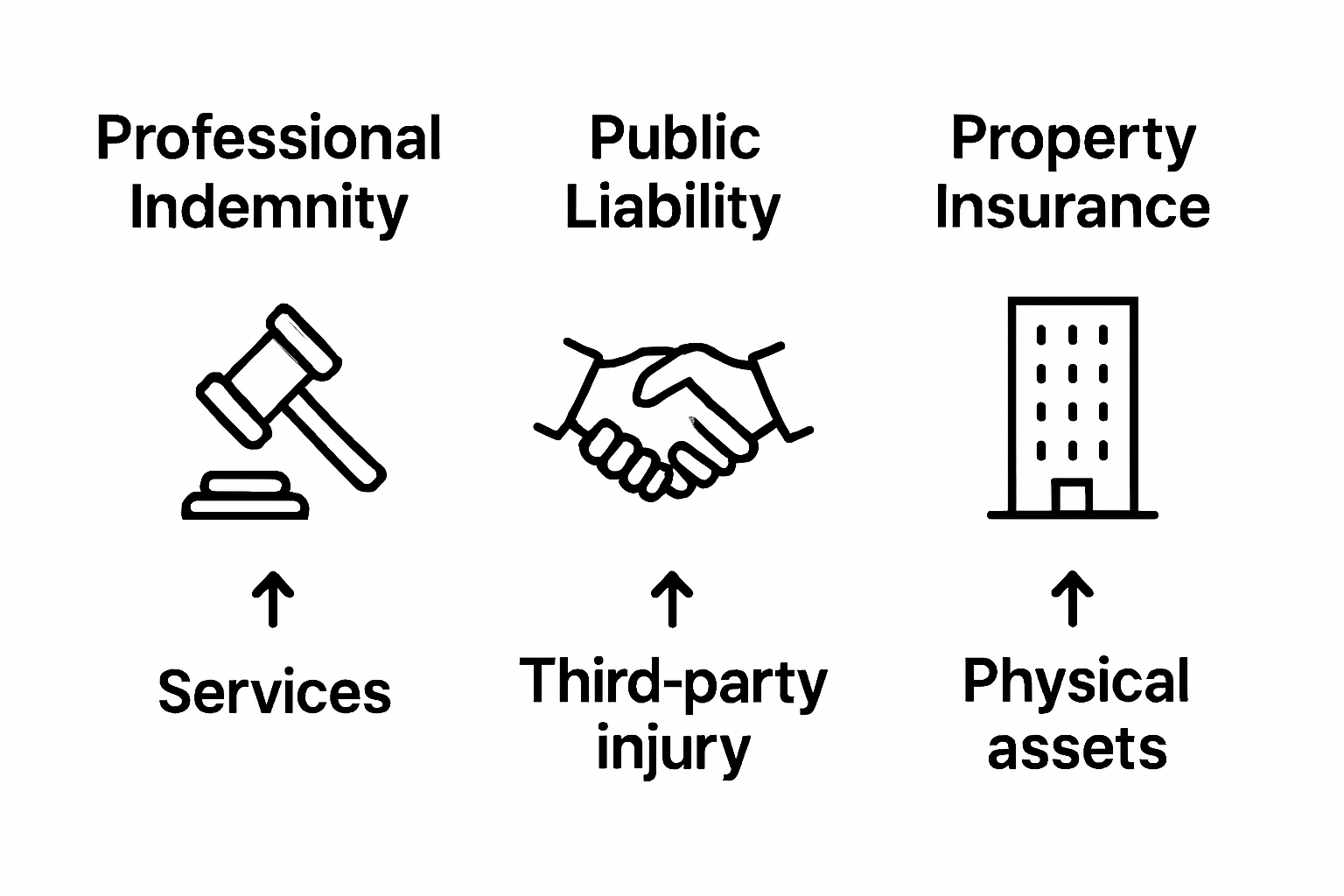

Types of Business Insurance Coverage

For clinics and service-based businesses, insurance coverage typically encompasses several key areas. Professional liability insurance protects against claims of negligence or inadequate professional services. Public liability insurance covers potential injuries or property damage that might occur on business premises. Property insurance safeguards physical assets like equipment, furniture, and specialized medical or aesthetic tools.

Additionally, clinics might require specific insurance types such as:

Medical malpractice insurance

Equipment breakdown coverage

Business interruption insurance

Cyber liability protection

By understanding and strategically selecting appropriate insurance products, businesses can create a robust financial safety net that protects against unforeseen challenges and potential financial setbacks.

Importance of Business Insurance for Clinics and Salons

Business insurance is not merely a legal requirement but a strategic investment that protects the financial health and operational stability of clinics and salons. These service-based businesses face unique risks that demand comprehensive insurance coverage to mitigate potential financial and legal challenges.

Financial Protection and Risk Mitigation

For clinics and salons, business insurance serves as a critical financial shield against unexpected events. According to Business Queensland, these policies help transfer potential risks that could otherwise cause significant financial disruption. Potential risks include:

Client injury or property damage

Professional negligence claims

Equipment breakdown

Unexpected business interruptions

Legal expenses and compensation costs

The financial implications of an uninsured incident can be catastrophic. A single lawsuit or major equipment failure could potentially bankrupt a small clinic or salon, making insurance an essential protective measure.

Comprehensive Coverage for Service Industries

Service-based businesses like clinics and salons require specialized insurance that addresses their unique operational landscape. Key insurance types include:

Professional indemnity insurance

Public liability coverage

Equipment and property insurance

Workers compensation insurance

By understanding business finance basics, clinic owners can strategically select insurance products that provide robust protection while maintaining financial efficiency.

Moreover, comprehensive business insurance offers more than financial protection. It provides peace of mind, allowing business owners to focus on delivering exceptional services without constant worry about potential risks. Insurance demonstrates professionalism to clients and can be a competitive advantage in attracting and retaining customers who value businesses with comprehensive risk management strategies.

Types of Business Insurance Relevant to Service Industries

Service industries like clinics, salons, and wellness centres require specialised insurance products that address their unique operational risks and professional challenges. Understanding the appropriate insurance types is crucial for comprehensive protection and sustainable business management.

Core Insurance Categories for Service Businesses

Insurance for service industries goes beyond standard business coverage, targeting specific professional and operational vulnerabilities.

According to Australian Business Insurance Guidelines, service businesses must consider multiple insurance categories to ensure complete protection.

Key insurance categories include:

Professional indemnity insurance

Public liability insurance

Property and equipment insurance

Workers compensation insurance

Cyber liability insurance

Professional and Operational Risk Coverage

Each insurance type serves a specific protective function for service industries. Professional indemnity insurance safeguards against claims of professional negligence or inadequate service delivery. Public liability insurance covers potential injuries or property damage occurring on business premises or during service delivery.

For clinics and salons, additional specialised coverages become critical:

Medical malpractice insurance

Equipment breakdown insurance

Business interruption insurance

Personal accident and illness coverage

Beyond financial protection, understanding business finance basics helps service industry professionals strategically select insurance products that balance comprehensive coverage with cost-effectiveness.

The right insurance mix not only mitigates financial risks but also demonstrates professional credibility, helping businesses build trust with clients and stakeholders. By carefully evaluating potential risks and selecting tailored insurance solutions, service businesses can create a robust safety net that supports long-term growth and stability.

How Business Insurance Works in Real-World Scenarios

Business insurance operates as a sophisticated risk management mechanism that transforms potential financial threats into manageable, predictable scenarios for service-based businesses. Understanding the practical application of insurance requires examining how policies function during actual business challenges.

Claims Process and Risk Assessment

The insurance claims process represents a critical mechanism for translating policy protection into real financial support. According to Australian Government Business Guidelines, the claims process involves several strategic steps:

Initial incident documentation

Formal claim submission

Insurance company investigation

Claim evaluation and potential compensation

Resolution and financial settlement

Risk assessment precedes policy issuance, where insurers meticulously evaluate a business's specific operational risks. Factors like professional service type, historical claim records, business size, and potential liability exposure determine premium rates and coverage scope.

Practical Insurance Scenario Examples

Real-world scenarios illustrate the tangible value of comprehensive business insurance. Consider these practical examples:

A physiotherapy clinic faces a negligence claim when a client experiences unexpected injury during treatment

A beauty salon experiences significant equipment damage from electrical malfunction

A wellness centre requires temporary closure due to unexpected property repairs

In each scenario, appropriate insurance coverage transforms potentially devastating financial events into manageable challenges.

Professional indemnity insurance would protect against negligence claims, property insurance covers equipment replacement, and business interruption insurance provides income replacement during unexpected closures.

By understanding business finance basics, service industry professionals can strategically select insurance products that offer robust, context-specific protection. Effective business insurance ultimately provides more than financial compensation it delivers peace of mind and operational resilience.

Key Concepts and Terms in Business Insurance Explained

Business insurance involves a complex ecosystem of technical terms and concepts that can often seem intimidating to service industry professionals. Understanding these fundamental terms is crucial for making informed insurance decisions and effectively managing business risks.

Core Insurance Terminology

According to Australian Business Insurance Guidelines, several key terms form the foundation of understanding business insurance:

Premium: The regular payment made to maintain insurance coverage

Deductible: The amount a business pays out of pocket before insurance coverage activates

Policy Limit: Maximum financial amount an insurer will pay for a specific claim

Exclusions: Specific scenarios or conditions not covered under an insurance policy

Endorsement: Modifications or additions to an existing insurance policy

Premiums represent the most direct interaction most businesses have with insurance. These periodic payments determine the level of protection and vary based on risk assessment, business type, and coverage extent.

Advanced Insurance Conceptual Framework

Beyond basic terminology, businesses must understand more nuanced insurance concepts. Risk transfer is a fundamental principle where financial uncertainty is shifted from the business to the insurance provider through a contractual agreement.

Key advanced concepts include:

Underwriting process

Actuarial risk assessment

Comprehensive versus named perils coverage

Retrospective and prospective insurance approaches

By understanding business finance basics, service industry professionals can decode these complex terms and make strategic insurance selections. Comprehensive understanding transforms insurance from a confusing administrative requirement into a powerful risk management tool.

Ultimately, mastering these concepts empowers businesses to negotiate better policies, understand their coverage limitations, and proactively manage potential financial risks.

The table below clarifies core business insurance terms to help clinic and salon owners better understand their policy documents and make informed decisions.

Deductible

he amount a business pays out of pocket before insurance coverage activates

Policy Limit

Maximum financial amount an insurer will pay for a specific claim

Exclusions

Specific scenarios or conditions not covered under an insurance policy

Endorsement

Modifications or additions to an existing insurance policy

Underwriting Process

The insurer’s evaluation of a business’s operational risks and insurance suitabilityActuarial

Assessment

The use of statistical methods to evaluate risk and set policy terms

Turn Risk into Reliable Growth for Your Clinic or Salon

You already know that business insurance is not just about having a safety net but about protecting your hard work from surprises like client injuries, negligence claims, or business interruptions. Yet, in the real world, reducing risk is only part of the puzzle. Consistent growth and dependable bookings are what truly keep your clinic thriving. Many clinics find themselves investing in insurance without a concrete strategy for steady leads or revenue, which creates an underlying vulnerability even with physical protection in place.

Now is the perfect time to complement your insurance with a proven marketing system that keeps your pipeline full and your business resilient. Business Warriors specialises in helping clinics and salons secure more bookings through our integrated digital marketing solutions designed specifically for service-based businesses. Take the next step and see how our scalable marketing strategies can work hand-in-hand with your insurance to build a stronger, more predictable business. Don’t wait until the next challenge hits—visit Business Warriors today and discover how you can outpace risk and competition, starting now.

Frequently Asked Questions

What is the primary purpose of business insurance for clinics?

Business insurance provides financial protection for clinics against potential risks and unexpected losses, ensuring operational continuity and mitigating legal liabilities.

What types of insurance coverage do clinics typically need?

Clinics typically require professional liability insurance, public liability insurance, property insurance, medical malpractice insurance, equipment breakdown coverage, and business interruption insurance.

How does the claims process work for business insurance?

The claims process involves documenting the incident, submitting a formal claim, and an insurance company investigation before evaluating the claim and potentially compensating the insured business.

Why is professional indemnity insurance important for clinics?

Professional indemnity insurance protects clinics from claims of negligence or inadequate professional services, safeguarding their financial stability and reputation.

Recommended

TESTIMONIALS

BOOK A FREE GROWTH SESSION TO GET A FULL FREE GO TO MARKET PLAN FOR THE NEXT LEVEL OF GROWTH IN YOUR BUSINESS WITH ONE OF OUR DIGITAL MARKETING AGENCY WARRIORS TODAY